Getting Over Your FOFA (Fear Of Financial Advice)

Getting Over Your FOFA (Fear Of Financial Advice)

- December 10, 2018

- Posted by: Daniel McGregor

As we enter December, we’re in the home stretch of 2018. Before you wrap things up for the year and clock off for the festive season, I want to challenge you just a little with a couple of questions.

In 2018, did you manage your money in a way that is going to IMPROVE your life?

Is what you’re doing today getting you closer to where you want to be tomorrow?

Or was 2018 another missed opportunity to put in place the strategies that will see you live the life you’ve earned?

Only you know the real answer. So, think about it and give yourself an honest answer.

Your answers to the questions reveal whether you’re putting yourself on track for the life you want to live or if you’re just going through the motions and will one day end up looking back wishing you’d been just a bit smarter with money a little earlier in life.

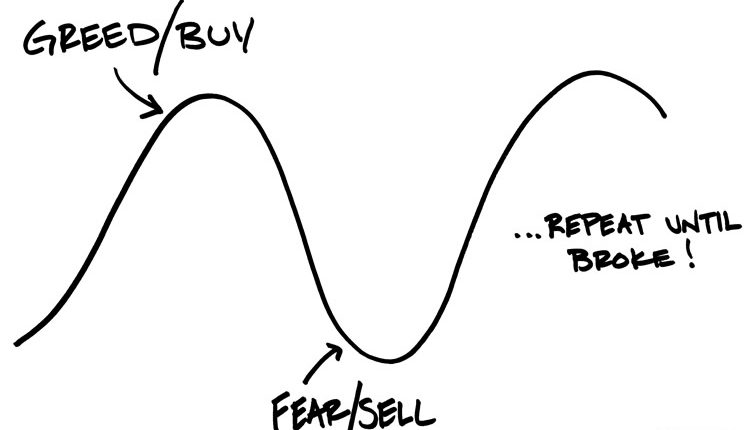

The life you want to live is worth pondering for a moment. I see so many people who are coasting through life thinking that they’re earning a decent income and getting the house paid off, not realising that they’re coasting head first into a financial disaster later in life. What they’re doing now is just not going to get the job done when it comes to creating the wealth needed to continue the lifestyle they enjoy when they get older.

Whether it’s with me or another financial adviser in town, I challenge you to get over your FOFA (Fear Of Financial Advice), take yourself out of your comfort zone and book an appointment to get some financial advice in the New Year. Go on, right now… jump on my website and book an appointment online, or Google who else is out there and book an appointment with them. Chances are that a financial adviser can show you a few things that can make a massive difference to what your life will look like many years from now. But if you never know what those things are and never get around to doing them, you will simply miss out.

What choices would more money in the future allow to have? The simple fact is that money doesn’t buy stuff, it buys choices.

Hope is not a plan and yet that is most people’s plan when it comes to securing their financial future. They know they need to do something, they just don’t know what the right something is and they don’t know who to trust. Trust an expert, trust someone independent who charges an easy-to-understand fee and get the advice you need to make sure that you and your family will reap the benefits of all the work you do to earn an income by creating the wealth that income can generate.

You’re not going to get rich quickly but if you put the right strategies in place, you run the very serious risk of getting rich slowly! What a shocking thing to have to live with… more money and more choices in the future. Getting rich is not about having a fabulous fortune, it’s about having enough to be able to enjoy the lifestyle you enjoy now throughout the rest of your life.

Think back to your answers to my questions… What will the answers be in another 12 months?

As the old Chinese proverb says, ‘The best time to plant a tree was 20 years ago. The second best time is now.’

Hope is not a strategy and failing to plan is planning to fail. Take the initiative and lock in that appointment for January 2019 and let’s get you on track.

Cheers,

Daniel