Are you in the retirement risk zone?

There is a period before and after retirement called the retirement risk zone… it’s a dangerous place! It is typically considered to be the 5 years either side of retirement. This decade is when most people’s retirement savings reach their peak and start being accessed. Often people work hard to squirrel away as much as […]

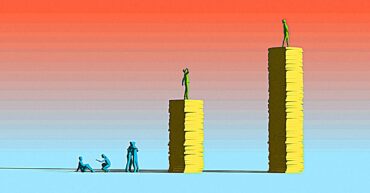

Is it possible you’re one of the money G.I.A.N.T.S? Money G.I.A.N.T.S are people with Good Income And Nothing To Show. It may be more likely that rather than nothing to show, you simply don’t have as much as you should for all your years of hard work up until this point. Let’s dig a little […]

Here’s a statistic that will likely surprise most people: Chant West has found that the median growth fund in superannuation lost only 0.5% in the 2019/20 financial year. To me, that’s the equivalent of breaking even! Admittedly, it was a rollercoaster ride through last financial year. Chant West’s research found growth funds gained 6.4% in […]

As you get older, you increasingly think more about the future. Retirement is one of those things that people start to think more about as they get older. While thinking about it is great, planning for it at the same time is even better! Most of us are often in a state of cruise control […]

Money makes the world go round… or so the saying goes. I’d argue there is one thing far more valuable than money – time! When it comes to your money, it’s something you have to work for. You give your time for money. It’s an eye-opener to start to think about how much time is […]

During the coronavirus pandemic, thousands of Australians have found time to start taking an interest in investing. So, I thought I’d run you through the biggest investment mistakes people make in the hope you can avoid them… TIME Often one of the biggest mistakes is not starting early enough. Most people underestimate how much they […]

Are you a retiree? Perhaps you’re nearing retirement or maybe you’re simply ready to start seriously planning for your retirement. If so, can you answer this one vital question? Do you really know how the fees on your retirement savings compare with what else is out there? Why is this question so vital? Because a […]

Last week I compared how you could pay for financial advice… this week, I’ll compare how you can pay for your superannuation. Why would we do this? Well, your super is going to be the backbone of your retirement savings, it’s compulsory and it’s the best tax break in town. If you haven’t been paying […]

Sometimes I feel like a bit of a broken record, but I also get a lot of people coming to me saying they’ve been reading these pieces for 6 or 12 months or more and have just got around to doing something about it. After all, it’s far easier to live in the here and now […]

Fuel prices are one of those things that are always in the news. And they’ve been quite topical of late with tumbling oil prices and fuel now at prices not seen for decades! Petrol, diesel, regardless which fuel powers you from A to B, fuel prices are one of those things we are always sensitive […]